In Minnesota, you can get a real estate license by meeting certain requirements. Minnesota Commerce Department wants to ensure that all real estate agents are licensed and competent to work in the state. The requirements for real estate agents include having to be at the least 18 years of age, being U.S. citizens and lawfully admitted aliens. Although most users are not concerned about citizenship, you could be denied a license in the event of any criminal history or unpaid judgments. It is possible to refuse a license if you engage in illegal real estate activities.

Pre-license education

Pre-license education is a crucial part of becoming licensed in Minnesota as a real estate agent. It can increase your chances for passing the exam, and it will also help you avoid having to take it again. Minnesota's licensing process for real estate agents takes about four months. Pre-licensing is contingent on passing the exam, passing the education course and being sponsored by a licensed brokerage.

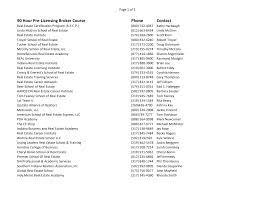

A great way to start your education for your real estate license in Minnesota is by taking a pre-license course online. Three 30-hour courses can be taken to help you get your license. These courses cover topics like valuation, financing, contracts and real estate principles. You can complete the course online through a provider such as ContinuingEd Express. They offer live streaming as well as online courses.

Requirements for continuing education

Real estate salespersons in Minnesota must complete at least fifteen hours of continuing education each year. The total amount of continuing education required for Minnesota real estate salespersons is 30 hours. This applies over a two-year renewal. You can complete the required CE in real estate through a variety of methods, including online classes or on-demand webinars. Kaplan provides both live and on-demand classes to fulfill the state's continuing educational requirements. Kaplan's online courses can be approved for 3.75 hours real estate CE. They also qualify for fair housing credit and agency credit.

Minnesota Real Estate Commission has adopted new real estate CE credit system. This means real estate licensees have to complete at most eight hours of continuing training in a single day. But no more than 15 hours per 24-hour period. Brokers and salespeople must take a pre-licensing CE module every year to be compliant with Minnesota's continuing education requirements. These courses provide 3.75 hours CE credit and must be completed prior to June 30, 2022. You can also take the course online, even if you don't have a live instructor. Some courses can be viewed live, and others are self-paced. Exam prep courses cover both national and state sections of the Minnesota licensing exam.

Exam

Minnesota requires that you pass an exam to obtain a license to sell real estate. This process helps protect the public by ensuring that the individual possesses a certain level of competence. The state regulatory agency establishes a standard for safe practices. The exam is designed to confirm that an individual has met those standards. Pearson VUE administers Minnesota’s real-estate licensing examination.

Minnesota's real estate license requires that applicants have successfully completed both a prelicense education program and passed the state exam. The state demands that applicants are at minimum 18 years old and a lawful permanent citizen of the United States. Minnesota has reciprocity arrangements with several other states including Wisconsin. Minnesota does not require you to take a prelicensing program if you are a licensed agent from a reciprocal state. The PULSE Portal allows you to apply online and send a letter attesting to your current license. You will also be able pass the state section of the exam. In Wisconsin, however, you must take a 13-hour Wisconsin-to-Minneseta prelicensing course.

Cost

The first step in becoming a real estate agent in Minnesota is to obtain a real estate license. The process is virtually completely online, with the exception of the actual exam, which must be taken in person. This article will detail the process and tell you how much it will cost. We will also talk about the exam content and offer some resources for further information.

Minnesota's pre-licensing requirements require that real estate agents complete 90 hours. These can either be taken online, or in classrooms. On-demand online courses are usually the most cost-effective. A package that includes three courses typically costs $200 to $300.

FAQ

Should I use an mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers are able to work with multiple lenders and help you negotiate the best rate. Some brokers earn a commission from the lender. Before signing up for any broker, it is important to verify the fees.

What is a Reverse Mortgage?

A reverse mortgage lets you borrow money directly from your home. You can draw money from your home equity, while you live in the property. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance will cover the repayment.

How much does it cost to replace windows?

Replacement windows can cost anywhere from $1,500 to $3,000. The cost to replace all your windows depends on their size, style and brand.

What amount should I save to buy a house?

It depends on the length of your stay. It is important to start saving as soon as you can if you intend to stay there for more than five years. If you plan to move in two years, you don't need to worry as much.

How do I get rid termites & other pests from my home?

Over time, termites and other pests can take over your home. They can cause serious damage to wood structures like decks or furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

What should you look out for when investing in real-estate?

It is important to ensure that you have enough money in order to invest your money in real estate. If you don’t have the money to invest in real estate, you can borrow money from a bank. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You also need to make sure that you know how much you can spend on an investment property each month. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Finally, ensure the safety of your area before you buy an investment property. It would be best if you lived elsewhere while looking at properties.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to Find Houses to Rent

Moving to a new area is not easy. It may take time to find the right house. Many factors affect your decision-making process when choosing a home. These factors include location, size and number of rooms as well as amenities and price range.

You can get the best deal by looking early for properties. For recommendations, you can also ask family members, landlords and real estate agents as well as property managers. This will allow you to have many choices.