Lender agents can be a valuable partner in the home-buying process. Lenders are financial backers for potential homeowners. They can help secure a mortgage to make the purchase possible. Lenders who are trustworthy and reliable will keep their clients informed at all stages of the loan process. They will also be able to offer valuable advice and suggestions. Potential homeowners will find that lenders are an excellent source of information. They can advise you on the best loan products and types available.

The right lender will also be able to provide a range of financial services including a refinance and a loan for the down payment. The right broker can find the right loan for you at the best rate. They can make loan applications as easy as possible.

If you are looking for a financial steward, a lender is not the only person that may come to your mind. There are many options available for lenders today, so it is important to be able select one that is right for you. There are many options for loan products available to home buyers. Each has its own unique benefits and drawbacks, and you should be sure to find out what type of loan you are eligible for before signing on the dotted line.

It can be daunting to choose the right lender. However, it is worth the effort. Lenders provide a great resource to help you with your home buying needs. Finding the right lender will make it a pleasant and stress-free experience. A lender who is qualified will help you find the perfect home and provide the financial security you require. Lenders may also be able to recommend real estate agents qualified to help you locate your dream home. Talk to them about the connections they have if you are interested in an agent.

If you're looking for a mortgage to purchase a home, it's crucial to thoroughly understand your financial situation. Lenders are a good source of information about home loans, and they will be able to give you the low down on loan requirements, types of loans, and how to make your budget work for you. Lenders can recommend loan products that suit your needs and make loan applications as easy as possible.

Talking to local real estate agents, banks and other lending institutions is the best way for you to find out more about the lender in your region. Knowing the local marketplace will help you be more knowledgeable about lenders. This will make you more successful in the long term. You will have a smooth home buying experience and a reliable resource for years.

FAQ

Is it better for me to rent or buy?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. A home purchase has many advantages. For instance, you will have more control over your living situation.

What is a "reverse mortgage"?

Reverse mortgages are a way to borrow funds from your home, without having any equity. It allows you access to your home equity and allow you to live there while drawing down money. There are two types: conventional and government-insured (FHA). A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance will cover the repayment.

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

What are the downsides to a fixed-rate loan?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. You may also lose a lot if your house is sold before the term ends.

Can I buy a house in my own money?

Yes! Yes. These programs include FHA, VA loans or USDA loans as well conventional mortgages. Visit our website for more information.

What is the cost of replacing windows?

Replacing windows costs between $1,500-$3,000 per window. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

What amount of money can I get for my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com reports that the average selling price of a US home is $203,000. This

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

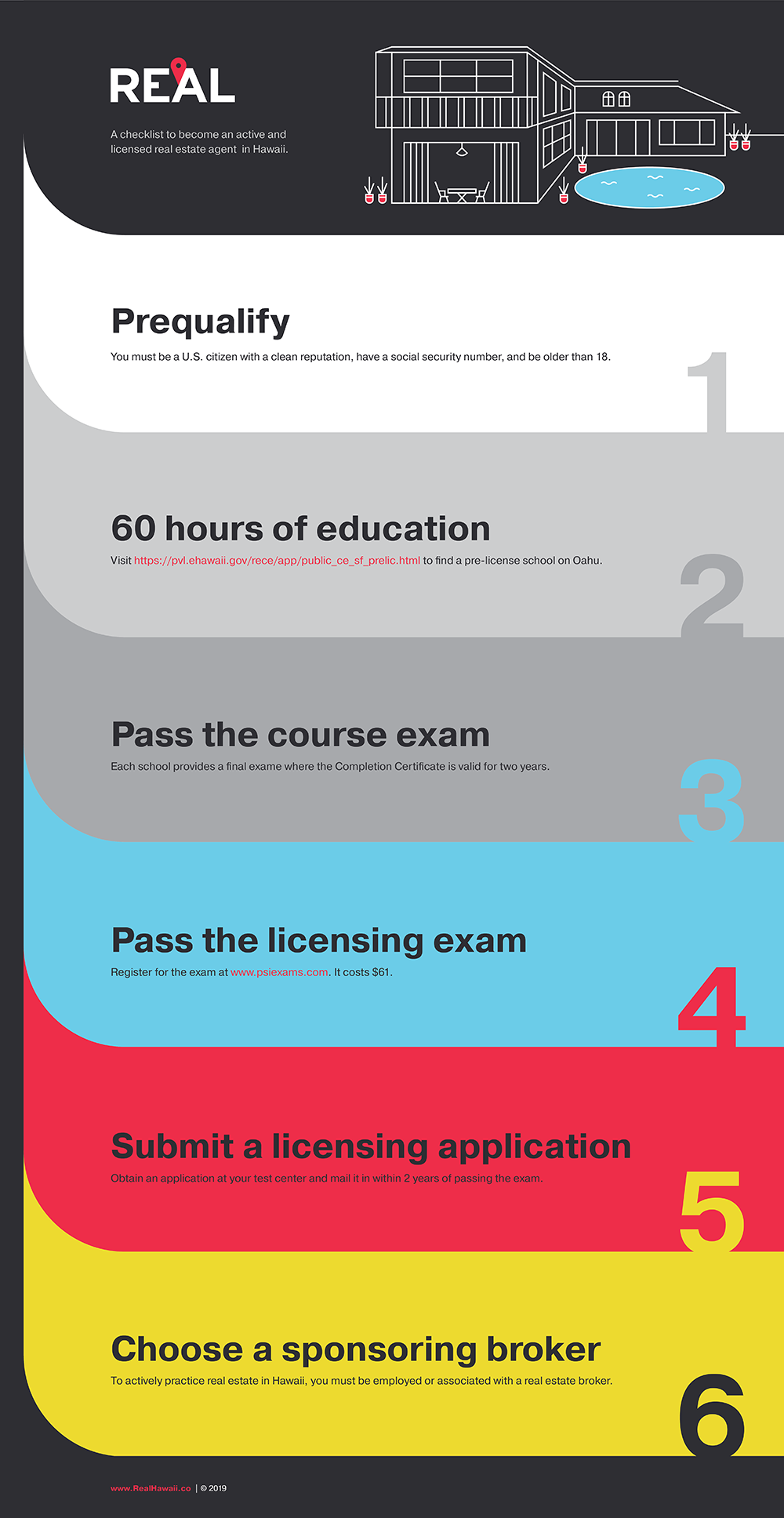

How to be a real-estate broker

You must first take an introductory course to become a licensed real estate agent.

Next you must pass a qualifying exam to test your knowledge. This requires you to study for at least two hours per day for a period of three months.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!