The Delaware real estate commission is the ultimate enforcer of all real estate laws and regulations in the state. The Delaware real estate commission is comprised of nine members who are all appointed by Governor. Five members of the commission must be professionals in real estate and four others must come from the general public.

How to Be a Real Estate Broker in Delaware

The first thing you need to do in order to become a Delaware Real Estate Agent is complete the necessary pre-licensing classes and pass the licensing exams. These classes may be taken either in a class setting or online.

You must also select a broker as your sponsor and submit a licensing application. You will also need to meet the other licensing requirements such as a background screening and continuing education.

How to Get a Real Estate License Delaware

To get your license, first you need to open a DELPROS application and pay $131. You can then upload any documentation that you will need to send with your application. Documents that require a stamp or notary signature must be submitted with your application.

The approval of your application will take three to five days. This could take up to five working days. After this, your DELPROS account will allow you to print out your license.

How to pass the Delaware Real Estate Exam

Delaware realty salesperson examination is the second step to getting your Delaware license. This exam is administered by the global testing company Pearson VUE. The test is divided into two sections, one national and the other state. Scores of 70 and higher are considered passing.

How to Prepare the Delaware Real Estate Agent Exam

It is important to prepare well before taking your exam. This can be done by enrolling in a pre-license class that provides you with the necessary tools for success on the test. You should spend a lot of time studying so that you can pass the exam at your first attempt.

How to Become a Real estate Agent in Delaware

Attending a Delaware real estate school offering the state-approved course for pre-licensing will allow you to become a licensed real estate agent. You can also find a good local real estate school in your area, but make sure it's accredited by the real estate commission before you sign up.

You can also find many online real-estate schools in the United States. However, you must choose a school that is reputable to have a good chance of getting your license. A high-quality real estate school will provide you with the resources you need to succeed in this industry and help you pass your state exam on your first try.

How to Be a Salesperson Delaware

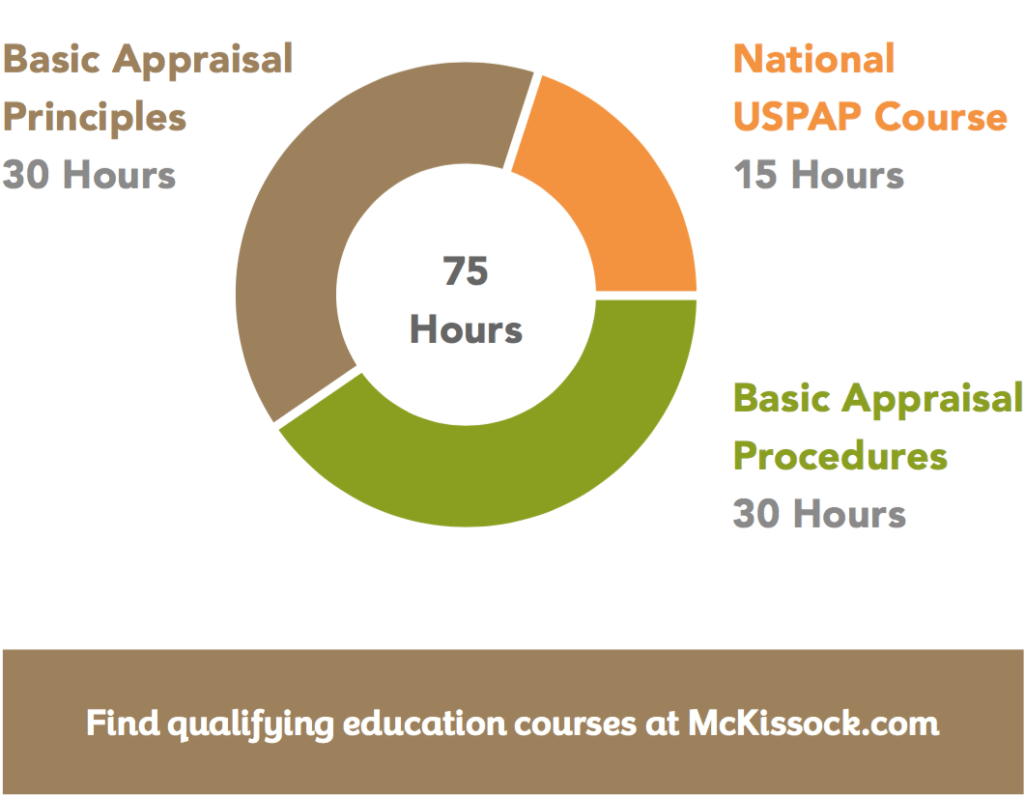

Delaware requires real estate salespeople complete 99 hours in pre-licensing courses before they are eligible to sit for their license. These courses, which can be completed either in a traditional classroom or online, cover the basics of being a real estate agent.

FAQ

What can I do to fix my roof?

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. Contact us for further information.

Is it possible fast to sell your house?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. You should be aware of some things before you make this move. First, you need to find a buyer and negotiate a contract. Second, you need to prepare your house for sale. Third, your property must be advertised. You should also be open to accepting offers.

Should I rent or own a condo?

If you plan to stay in your condo for only a short period of time, renting might be a good option. Renting saves you money on maintenance fees and other monthly costs. A condo purchase gives you full ownership of the unit. You can use the space as you see fit.

How do you calculate your interest rate?

Interest rates change daily based on market conditions. The average interest rates for the last week were 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

What are the three most important things to consider when purchasing a house

When buying any type or home, the three most important factors are price, location, and size. Location is the location you choose to live. Price refers the amount that you are willing and able to pay for the property. Size refers how much space you require.

Can I afford a downpayment to buy a house?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include government-backed loans (FHA), VA loans, USDA loans, and conventional mortgages. Visit our website for more information.

How do I eliminate termites and other pests?

Your home will be destroyed by termites and other pests over time. They can cause serious damage to wood structures like decks or furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

While renting your home can make you extra money, there are many things that you should think about before making the decision. This article will help you decide whether you want to rent your house and provide tips for managing a rental property.

This is the place to start if you are thinking about renting out your home.

-

What is the first thing I should do? Before you decide if you want to rent out your house, take a look at your finances. If you are in debt, such as mortgage or credit card payments, it may be difficult to pay another person to live in your home while on vacation. Also, you should review your budget to see if there is enough money to pay your monthly expenses (rent and utilities, insurance, etc. ), it might not be worth it.

-

How much is it to rent my home? Many factors go into calculating the amount you could charge for letting your home. These include things like location, size, features, condition, and even the season. Remember that prices can vary depending on where your live so you shouldn't expect to receive the same rate anywhere. The average market price for renting a one-bedroom flat in London is PS1,400 per month, according to Rightmove. This means that you could earn about PS2,800 annually if you rent your entire home. Although this is quite a high income, you can probably make a lot more if you rent out a smaller portion of your home.

-

Is it worthwhile? Doing something new always comes with risks, but if it brings in extra income, why wouldn't you try it? You need to be clear about what you're signing before you do anything. Renting your home won't just mean spending more time away from your family; you'll also need to keep up with maintenance costs, pay for repairs and keep the place clean. Before you sign up, make sure to thoroughly consider all of these points.

-

Are there any benefits? You now know the costs of renting out your house and feel confident in its value. Now, think about the benefits. Renting out your home can be used for many reasons. You could pay off your debts, save money for the future, take a vacation, or just enjoy a break from everyday life. No matter what your choice, renting is likely to be more rewarding than working every single day. And if you plan ahead, you could even turn to rent into a full-time job.

-

How can I find tenants Once you decide that you want to rent out your property, it is important to properly market it. Listing your property online through websites like Rightmove or Zoopla is a good place to start. Once potential tenants reach out to you, schedule an interview. This will allow you to assess their suitability, and make sure they are financially sound enough to move into your house.

-

What can I do to make sure my home is protected? If you fear that your home will be left empty, you need to ensure your home is protected against theft, damage, or fire. You will need insurance for your home. This can be done through your landlord directly or with an agent. Your landlord will typically require you to add them in as additional insured. This covers damages to your property that occur while you aren't there. However, this doesn't apply if you're living abroad or if your landlord isn't registered with UK insurers. In this case, you'll need to register with an international insurer.

-

If you work outside of your home, it might seem like you don't have enough money to spend hours looking for tenants. You must put your best foot forward when advertising property. Make sure you have a professional looking website. Also, make sure to post your ads online. You'll also need to prepare a thorough application form and provide references. Some prefer to do it all themselves. Others hire agents to help with the paperwork. It doesn't matter what you do, you will need to be ready for questions during interviews.

-

What happens once I find my tenant If you have a current lease in place you'll need inform your tenant about changes, such moving dates. Otherwise, you can negotiate the length of stay, deposit, and other details. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do I collect the rent? When it comes time for you to collect your rent, check to see if the tenant has paid. You will need to remind your tenant of their obligations if they don't pay. After sending them a final statement, you can deduct any outstanding rent payments. If you are having difficulty finding your tenant, you can always contact the police. The police won't ordinarily evict unless there's been breach of contract. If necessary, they may issue a warrant.

-

How can I avoid problems? Renting out your house can make you a lot of money, but it's also important to stay safe. Consider installing security cameras and smoke alarms. Also, make sure you check with your neighbors to see if they allow you to leave your home unlocked at night. You also need adequate insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.