Negotiating realtor fees is a key part of selling or buying a home. It is possible to save thousands on the fees of your real estate agent. A reduction in the fee paid by your agent can help you to reduce closing costs and make sure that your sale goes smoothly.

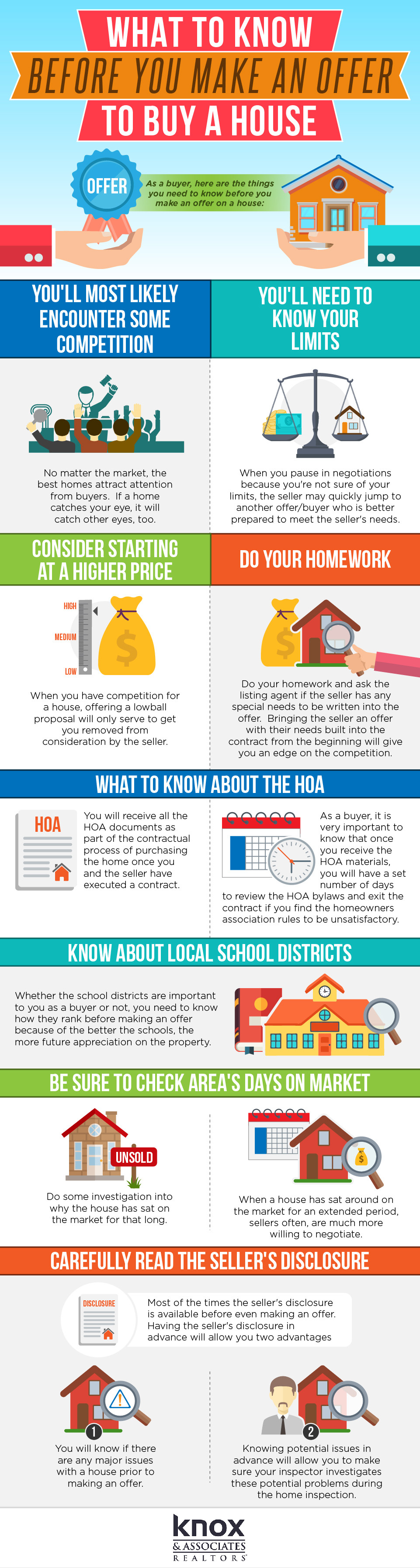

To negotiate realtor fees, the first step is to get to know the market. Find information about similar homes to yours regarding price, location and condition. Also, ask your agent what services he provides. This will allow you to learn about the services that your agent offers. It also allows you to see what the agent's commission rates are. Zillow allows you to get a good idea of the market for local housing.

A high-priced home may allow you to lower your commission. This is especially true if you're in a market that is fast-selling. It's not guaranteed that you will get a lower commission. Also, less experienced agents might be motivated to sell more, which could make them more reluctant to reduce their commission.

The next thing to keep in mind is that you'll have to justify the lower rate. If your home isn't selling as quickly as you would like, it's likely that your agent will use this as an objection in the negotiation. You'll need more work if there are fewer buyers.

Last tip: Have a number in mind and show up. This will give you a better chance of success. A 4.5% commission is a better option than the standard 66%. This will save you a staggering $3899 in realtor fee costs.

It is important to learn how to leverage your personal market research and knowledge to convince your agent that the price you are charging is fair. In addition to lowering the commission of your agent, you may also be able to negotiate the price for your home. Buying a home is one of the largest financial transactions you'll make. If you are willing to spend the time and effort necessary to get a higher price on your home, it will be worth it.

Another option is to use a dual-agent, which means the same agent represents both the buyer as well as you. This allows you to reach a wider range of potential buyers and can result is a higher asking price. It is not legal in all states. This can also increase the liability of your agent.

You may be able negotiate a reduced fee by listing your home in the fall or winter. While these times are less popular, you can still expect a lower price.

FAQ

How do I calculate my interest rates?

Market conditions affect the rate of interest. The average interest rates for the last week were 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

How can I get rid Termites & Other Pests?

Over time, termites and other pests can take over your home. They can cause severe damage to wooden structures, such as decks and furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

How long does it usually take to get your mortgage approved?

It depends on many factors like credit score, income, type of loan, etc. It generally takes about 30 days to get your mortgage approved.

How do I know if my house is worth selling?

Your home may not be priced correctly if your asking price is too low. You may not get enough interest in the home if your asking price is lower than the market value. For more information on current market conditions, download our Home Value Report.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This guarantees that your interest rate will not rise. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Find Houses to Rent

Moving to a new area is not easy. It may take time to find the right house. There are many factors that can influence your decision-making process in choosing a home. These factors include size, amenities, price range, location and many others.

You should start looking at properties early to make sure that you get the best price. For recommendations, you can also ask family members, landlords and real estate agents as well as property managers. This will ensure that you have many options.