Flipping property is a real estate investment strategy in which an investor purchases a property that needs to be renovated, and then sells it at a higher price. It can be rewarding, but can also involve risk. There are some things to consider before you flip a house.

Whether you plan to flip or rent, it's important to know the pros and con of each so you can make an educated decision. Take into account your investment goals, lifestyle and preferences to make the right decision.

Flipping a property or house can be difficult, time-consuming work. It can be stressful, especially if you lack experience or patience.

To flip a property, you should have knowledge of the local market and be able to identify undervalued properties. The market is constantly changing so you should keep up to date with the latest trends.

To maximize your profits, it is crucial to purchase a property for the best price. This can be tricky for those who are new to the property business, but is vital for success.

It's not as simple as you might think to find a property that you want to flip, but you have many options. It's easy to search for houses online, using a web-based search engine. Or you can ask an estate agent to find you the perfect home.

A good estate agent will be able to guide you through the process of buying and selling properties, helping you find a great property that will make you money. They will have access to a wide range of properties that could be suitable for you to renovate and then sell at a high price.

You'll have to renovate the property once you've chosen it. This can be a time-consuming task and is expensive, so budgeting before starting work is essential.

If you are looking for a property, it's important to check its location. Public transport and schools should be easily accessible. Finding a house in good repair will also save you the money of having to fix major problems like a leaking water heater or faulty electric wiring.

The cost of renovating a home is high, so you need to hire an expert before starting the work. It can save you time and money.

To make a successful flip of a home, it is essential to have the right vision and be willing and able to invest in time, finances, and other resources necessary to realize that vision. Before you sign anything, it's important to understand the legal implications of the purchase and renovation.

FAQ

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They work with a variety of lenders to find the best deal. There are some brokers that charge a fee to provide this service. Others offer no cost services.

Can I buy my house without a down payment

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. You can find more information on our website.

What should I do before I purchase a house in my area?

It depends on how long you plan to live there. You should start saving now if you plan to stay at least five years. You don't have too much to worry about if you plan on moving in the next two years.

How much will it cost to replace windows

The cost of replacing windows is between $1,500 and $3,000 per window. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

What flood insurance do I need?

Flood Insurance protects you from flooding damage. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more information about flood insurance.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

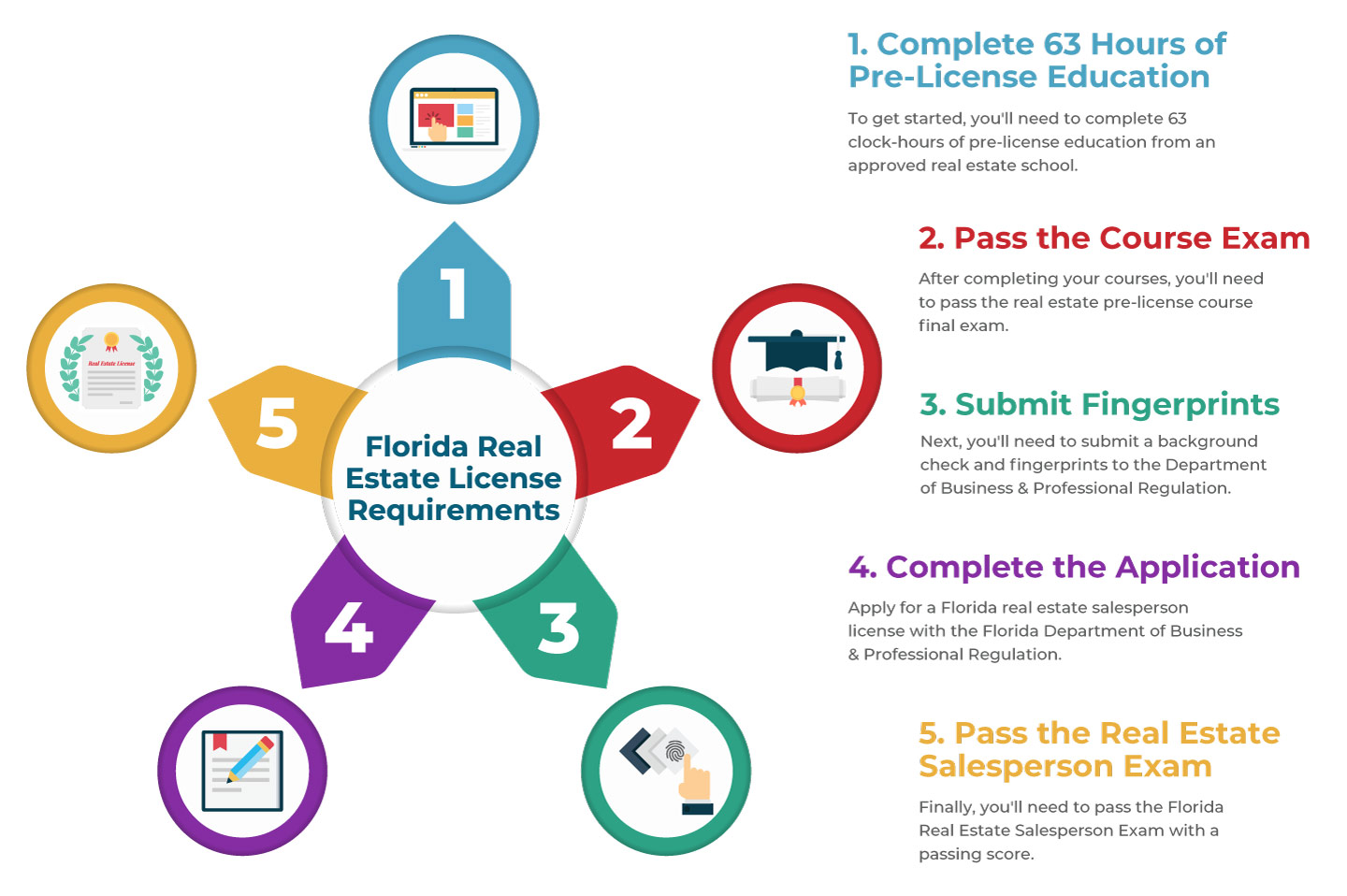

How to become an agent in real estate

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

All these exams must be passed before you can become a licensed real estate agent.